The exact same case relates to those that do not have a vehicle - insure. Non-owner vehicle insurance coverage is the perfect alternative for those who do not possess a car given that typical vehicle insurance policy can be pricey. That indicates that such individuals will certainly be covered in case of an additional crash, and they can likewise reveal proof of obligation insurance policy coverage to get their license reinstated.

The reason that non-owner SR-22 insurance coverage is less costly is that the insurer thinks that you do not drive usually, and also the only coverage you get, in this case, is for liability only (insurance companies). If you lease or borrow automobiles regularly, you need to think about non-owner car insurance also. Prices can vary throughout insurers, the ordinary yearly expense for non-owner cars and truck insurance coverage in California stands at $932.

Demands for An SR-22 in California First, understand that an SR-22 impacts your automobile insurance cost and also coverage. After a DUI sentence in The golden state, standard motorists pay an average of 166% even more than car protection for SR-22 insurance policy. The minimal period for having an SR-22 in California is 3 years, however one may require it longer than that, relying on their instance and crime.

In any of these scenarios, an SR-26 form can be submitted by your insurance provider. When that takes place, your insurer needs to indicate that you no more have insurance protection with the entity. Starting the SR-22 process over once again will be essential if your company files an SR-26 prior to finishing your SR-22 demand.

MIS-Insurance deals low-cost SR22 insurance policy that will save you money over the life of your policy. Economical SR22 insurance is offered and we will can assist you safeguard the right plan for you. The factor is that each insurance firm utilizes its requirements when examining your driving history. On the various other hand, The golden state regulation restricts firms from increasing prices or canceling your policy in the middle of its term.

A DUI will instantly boost your prices without considering added price increases as well as reject you price cuts even if you were previously getting a good chauffeur price cut. As an example, rather than paying $100 regular monthly for cars and truck insurance coverage, a vehicle driver without DUI background will only pay $80 month-to-month, thanks to the 20% excellent chauffeur discount rate they receive.

See This Report on Sr22 Certificate (Proof Of Insurance/financial Responsibility)

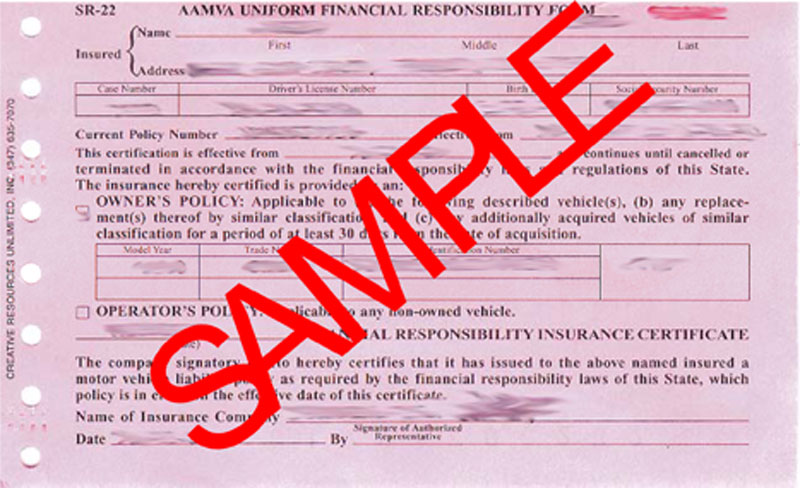

What you need to find out about SR-22 Filing in The golden state When it comes to concerns relating to vehicle insurance, our driving records, and also legal rights and also advantages, often we are taught things that simply are not true. vehicle insurance. Allow's check out a few of one of the most common misconceptions and also misconceptions pertaining to the SR-22 The golden state: What is the SR-22 Driver Declaring? An SR-22 is a certificate of insurance submitted by your insurance provider straight to the Division of Electric Motor Autos.

SR-22 Minimum Liability Limits The minimum obligation limitations need to meet your state's demands. Your Cost-U-Less customer service agent can inform you what the minimum needs are for your state. coverage. Just How the SR-22 Filing Refine Works There is very little for you to do in this procedure. All you have to do is request your insurer to file an SR-22 for you, then the insurance provider looks after the rest.

Prevent Future SR-22 Cancellations and Suspensions Once you have your SR-22 insurance coverage, you want to make sure it does not get cancelled or suspended. The earlier you renew it, the much safer you'll be as well as the much less likely your SR-22 will certainly be terminated.

bureau of motor vehicles ignition interlock car insurance liability insurance motor vehicle safety

bureau of motor vehicles ignition interlock car insurance liability insurance motor vehicle safety

When Is an SR-22 Required? Not all states require an SR-22, yet the ones that do might need them for any of the adhering to reasons: Unsatisfied Judgments Major Convictions Permit Suspensions No Insurance Violations No Insurance At The Time Of The Accident California SR-22 Declaring Cost-U-Less can assist you submit an SR-22 in California and we can additionally help you obtain inexpensive SR-22 insurance.

Filing fees are quite reduced, motorists that require SR-22 insurance coverage will certainly find that their rates are more costly due to the Drunk driving or other violation that led to the SR-22 need in the initial place. Just how much does SR-22 price in California? SR-22 insurance in The golden state will cost even more than what you formerly paid for automobile insurance policy, but this is mostly due to the offense that triggered you to require an SR-22 filing.

Whether your existing insurer will file an SR-22 for you, one of the most basic means to see to it you're obtaining the most cost effective SR-22 protection is to contrast quotes from multiple firms. Numerous significant insurance providers in California, including Progressive and Geico, will submit SR-22 forms. Given that every insurance firm assesses your motoring history according to its very own requirements, we advise comparing a minimum of 3 quotes to guarantee you're getting the very best rates.

An Unbiased View of Obtain An Sr-22 Insurance Form In Arizona - Dui Process ...

A vehicle driver with no-DUI history paying $100 per month for cars and truck insurance policy may get a 20% excellent driver price cut as well as only pay $80 per month. After obtaining a DRUNK DRIVING, the driver will be back to paying at the very least $100 each month, which is 25% greater than the prior discount price.

Note that the SR-22 insurance plan requires to detail all cars you have or routinely drive (sr22 insurance). How much time do you require to have an SR-22? The length of time you'll need to preserve SR-22 depends on your conviction, which should specify the length of time you're anticipated to keep the SR-22 declaring.

Maintaining constant protection is very important. Any type of gaps in your SR-22 vehicle insurance coverage will cause your driving opportunities to be put on hold again, as your insurance company would certainly file an SR-26 kind with the DMV notifying them of Article source the lapse - insurance group. If you vacate California during your necessary filing duration, you'll need to situate an insurer that does service in both states and also agrees to submit the kind for you in the state.

Throughout the one decade following a DUI, you won't be qualified for an excellent chauffeur discount rate in California (liability insurance). After this duration has actually run out, the drunk driving will certainly be removed from your driving document and also you will be eligible for the discount once again. You might have the ability to obtain the conviction eliminated from your document previously, but as long as you remain with the same insurance firm, the company will find out about the drunk driving and remain to utilize it when determining your SR-22 insurance prices.

However it provides coverage if you occasionally drive other individuals's autos with their consent. For those that do not own an auto, non-owner SR-22 insurance policy is a policy that gives the state-required liability insurance policy however is linked to you as the driver, no issue which car you utilize. Among the advantages of non-owner SR-22 insurance is that quotes are usually cheaper than for a proprietor's plan, because you'll just receive obligation protection and also the insurer thinks you drive much less frequently. liability insurance.

These prices were openly sourced from insurance firm filings as well as need to be used for comparative objectives only your own quotes may be different - motor vehicle safety.

The Ultimate Guide To Sr-22 Car Insurance: A Guide (With Quotes, Updated April ...

insurance insurance companies insurance companies department of motor vehicles no-fault insurance

insurance insurance companies insurance companies department of motor vehicles no-fault insurance

dui driver's license department of motor vehicles sr22 coverage dui

dui driver's license department of motor vehicles sr22 coverage dui

insurance group no-fault insurance bureau of motor vehicles driver's license insurance companies

insurance group no-fault insurance bureau of motor vehicles driver's license insurance companies

SR 22 Insurance policy There is a variety of kinds of automobile insurance that you are most likely acquainted with - from responsibility to detailed to crash - yet one kind you might not identify is SR22 insurance. SR22 insurance policy is an accreditation of monetary duty and is generally mandated by a court order adhering to a conviction for a significant traffic violation (bureau of motor vehicles).

What is SR22 car insurance policy? Commonly referred to as SR22 vehicle insurance, an SR22 is not in fact insurance coverage, but instead a certification of economic obligation sent to the Division (DMV) or Bureau of Motor Automobiles (BMV) on the insurance policy holder's part - insurance. It states that the insurance policy holder has actually the mandated coverage restrictions established forth by a court order after an infraction.

These violations might consist of the following: - one of the most usual factors for an SR22 required results from a driving drunk conviction. This uses to those convicted of driving while intoxicated or intoxicated of medicines that limit the chauffeur's ability. ignition interlock. - someone who is founded guilty of a significant web traffic offense such as driving negligently or recklessly, normally over of 20 miles per hour over the speed restriction, may be called for to have SR22 car insurance coverage.

- if a motorist is in an accident and does not have insurance policy coverage, the court might need them to have SR22 coverage after the crash. insurance group. - drivers seeking reinstatement after having actually a withdrawed or suspended certificate will certainly frequently be called for to have SR22 vehicle insurance policy prior to they're given authorization to drive again.

insurance coverage no-fault insurance dui dui

insurance coverage no-fault insurance dui dui

Those who already have coverage will certainly not require to get new insurance policy unless the provider drops them. Once the SR22 is submitted with the state, the insurance holder does not need to do anything except keep the protection (dui). SR-22 Insurance Coverage Providers Where to get an SR22 Several insurance policy suppliers offer SR22 coverage; the insurance holder just needs to request that a duplicate of their plan be sent to the DMV or BMV, relying on the state.

If you are bought to carry an SR22, it is a great idea to go shopping about for protection. Obtaining SR22 Cars And Truck Insurance Obtaining SR22 cars and truck insurance coverage is an easy process. When you choose an insurance provider for your protection, it can send the filing the same day you request it.

What Is Sr-22 Insurance And What Does It Do? - Allstate Can Be Fun For Anyone

Exactly how will an SR22 affect the expense of my insurance coverage? This happens because chauffeurs that are called for to have an SR22 are considered risky by insurance companies.

It is necessary to bear in mind that you will be in charge of the price of your deductible if you are associated with an accident so constantly select an insurance deductible that you can manage. One more means to decrease the premium price is to think about the sort of automobile you drive. Deluxe as well as sporting activities vehicles tend to be a lot more costly than cars and various other vehicles with high safety scores - underinsured.

Remember that some insurer use certain discounts on costs so speak to your agent and learn for what you may certify.